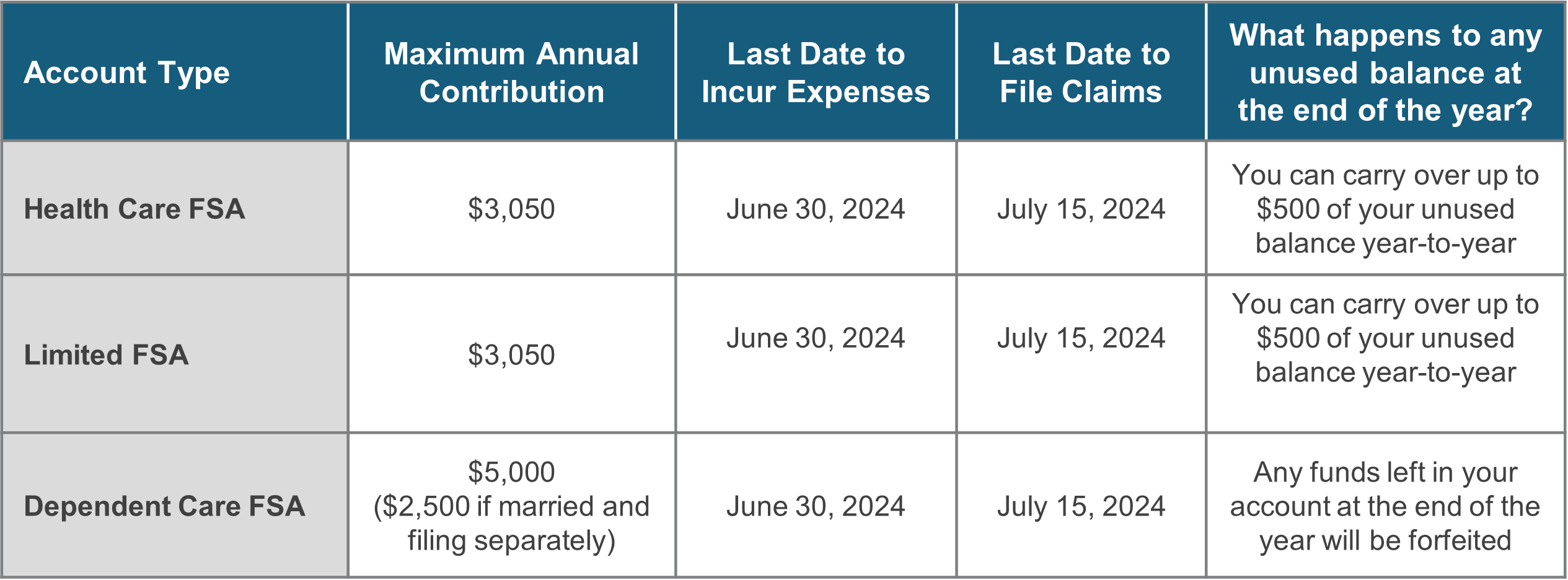

Health Care Flexible Spending Account

This account allows you to pay for a wide range of unreimbursed medical, dental and vision care expenses with pretax dollars. Eligible expenses include: Acid Controllers, Allergy & Sinus Medications, Antibiotic Products, Anti-Itch & Insect Bite, Digestive Aids, Laxatives, Pain Relievers, Respiratory Treatments, Sleep Aids & Sedatives, Stomach Remedies and Menstrual Supplies.

Limited Purpose Flexible Spending Account

This account is an option only available to those who elect the HDHP medical plan and open a Health Savings Account (HSA). This account is much like the Medical Reimbursement FSA, however, eligible expenses are limited to qualifying dental and vision expenses for you, your spouse, and your eligible dependents. Qualified dental expenses include cleanings, fillings, crowns and braces. Qualified vision expenses include contact lenses, eyeglasses, eye exams and vision correction procedures.

Important Note: No double dipping: Expenses reimbursed under your Limited-Purpose Flexible Spending Account cannot be reimbursed under any other plan or program – including a Health Savings Account (HSA). Only your eligible out-of-pocket expenses may be reimbursed.

Dependent Care Flexible Spending Account

This account is designed for you to pay, with pretax dollars, for qualified child care expenses for dependents under the age of 13 (or who are physically or mentally incapable of self-care) and for adult day care services for dependent adults who are unable to care for themselves and live with you at least 8 hours each day. The dependent care provided must be necessary for you (and your spouse, if you are married) to work or attend an accredited school or institution on a full-time basis. Funds may not be used to pay for overnight camps, care provided by a dependent, spouse or child under the age of 19 and care provided while you are not at work. Qualifying Dependent Care Expenses are those that enable you to be gainfully employed, including:

- Day-Care Centers

- Day Camps

- Babysitters

- Nannies

- Adult Day-Care Services

Dependent care services must have been “incurred,” or fully provided and completed, for the service period before you can be reimbursed for your dependent care expenses. This is important to remember because most providers require prepayment of dependent care services at the beginning of the service period before they provide dependent care services.

Important Note: Before you enroll in a Dependent Care FSA, you should evaluate the tax advantages, as well as the impact on your tax liability and your ability to take advantage of the Dependent Care Tax Credit. For a detailed listing of eligible and ineligible expenses, refer to IRS Publication 503, which is available from the IRS website at: https://www.irs.gov/publications/p503

How Do Flexible Spending Accounts Work?

Each year, you decide whether you want to participate in any of the Flexible Spending Accounts.

If you decide to participate, you must first determine how much you want to contribute to your FSA(s). The amount is based upon your estimation of how much money you and your family spend in deductibles, copayments and other eligible expenses each plan year.

During open enrollment, you enroll in the FSA(s) and elect the amount to contribute to your plan(s).

Beginning with the first pay period of the new plan year, the amount you elected will be automatically deducted from your paycheck in equal increments throughout the year and deposited into your account.

For Health Care or Limited-Purpose FSAs, your entire election amount is available to use on the first day of your plan year. For Dependent Care FSAs, the funds are only available as they are deposited into your account. You then use your funds to pay for eligible health care or dependent care expenses.

Click here to access your Wex FSA: Wex Login

For eligible tax-free FSA items and services, visit: The FSA Store